Financial Inclusion for All

Most of us do not think twice about writing a check to pay a bill, swiping a credit card to buy groceries or taking out a loan to buy a car. But while financial products and services are something many of us in the developed world take for granted, for more than 2.5 billion people — or half of the global adult population — access to these basic services is far from a reality. This leaves them vulnerable to financial instability and unable to absorb and recover from financial shocks that arise from unexpected illnesses, unstable employment or natural disasters. It imposes additional hardship on the poor and can overwhelm families for generations.

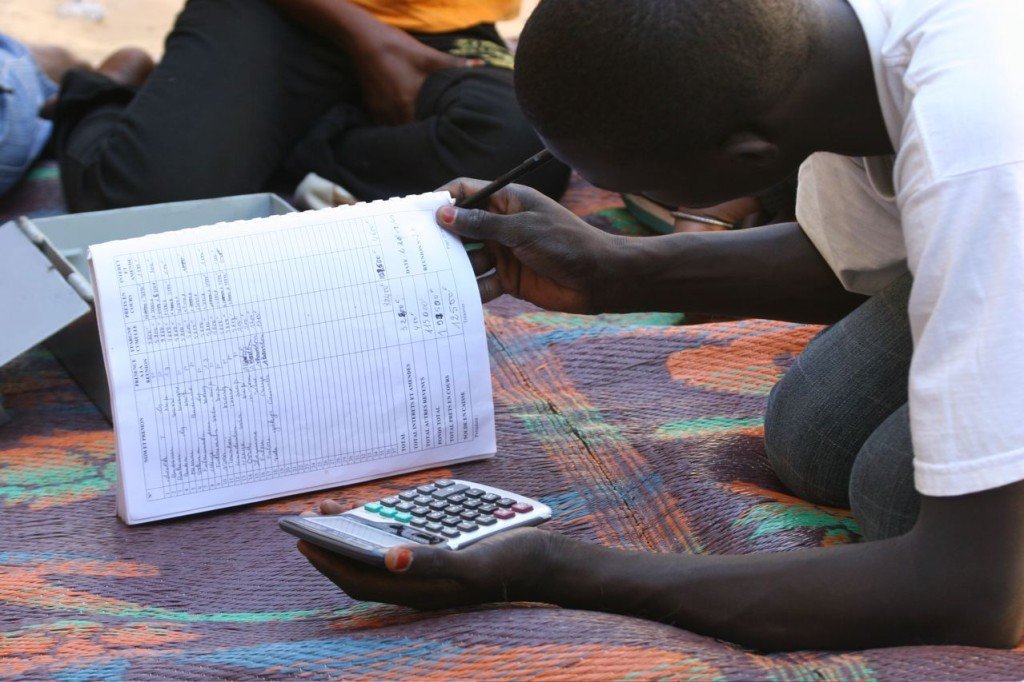

In areas of the world where access to formal financial services is limited, such as Africa, there have been several local, innovative developments. These include mobile money transfer systems like M-Pesa and EcoCash, or linking traditional informal savings groups to banks to help them save for the unexpected. Although these services can be groundbreaking, they only reach a small percentage of the population. Our focus should be on encouraging more innovation and supporting proliferation of these services across the continent.

Making sure that new developments and technologies help improve the conditions of people living in poverty is critical.

Access to financial products and services alone is not enough. Making sure that new developments and technologies help improve the conditions of people living in poverty is critical. Savings accounts that are successfully opened by the poor often sit unused due to lack of easy access to a branch, banking fees that are prohibitive or a lack of trust in the institution. When financial products are designed with the people they serve in mind, they will be relevant, appropriate and more likely to be used. As a result, those who live in poverty will be economically empowered and will become agents of change in their own lives.

The MasterCard Foundation recently hosted a Symposium on Financial Inclusion to address the above issues in partnership with the Boulder Institute of Microfinance, one of the sector’s leading organizations on financial inclusion. The gathering brought together experts in the sector to develop a deeper understanding of the financial lives of those who live in poverty and to identify how those who work in financial inclusion can better serve these clients.

The discussions resulted in guidelines for global financial inclusion efforts over the next decade, including:

1. Ensure empowerment is at the heart of inclusion. The goal of financial inclusion is to empower the individual. Products and services must be developed in ways that allow people to take charge of their finances and, ultimately, their lives. Two keys to empowerment are education and choice; therefore, equipping clients with the tools they need — rather than imposing them — will be crucial to long-term adoption.

2. Develop greater focus on customer-centricity. Putting clients at the center is about ensuring that products and services are designed around the real needs of people. Human-centered design has been utilized in retail and consumer sectors for many years, and is finally finding its place in financial inclusion. In sub-Saharan Africa for example, where we focus our work, regulatory constraints and travel distances to bank branches limit how people can manage their money. This results in low levels of access and high levels of dormancy in accounts. While experts agree on the importance of focusing financial technologies on the needs of the customer, practical applications and replicable business models of customer-centricity will ensure success on a wider scale.

3. Provide a strong motivation to use financial services. New financial tools should take into account the benefit of new technologies over currently used methods. There must be a strong motivation for individuals not only to take part in new technologies, but to maintain usage over the long term. For example, implementing a simple fee structure with interest rates based on the duration and amount of a savings account can encourage people to continue usage and can help to build trust.

4. Highlight long-term benefits to financial institutions. Reaching remote and unbanked populations can be an expensive endeavor for financial institutions. When people become long-term customers, however, they often invest more and take part in more profitable services such as credit and insurance. A long-term strategy benefits both the financial institution and the individual, and can contribute to more sustainable economic growth. The African Development Bank estimates that improving access to finance for small-holder farmers could triple the value of the continent’s agricultural output from $280 billion to $880 billion.

There is still much to be done before access to financial services can result in real change for families living in poverty. Client centricity is an important step toward this goal, but we need leaders in the sector to recognize its value. This is beginning to happen. During the Symposium, MicroCred COO Mark Flaming and Econet Wireless founder and Chairman Strive Masiyiwa, among others, spoke about the benefit of understanding client needs and aspirations in order to appropriately design financial products and services.

There is no silver bullet to ensure financial inclusion for all. Nevertheless, by working together to better understand and develop client-centered solutions to financial inclusion, we can go a long way to achieving that desired goal.